The future of

identity technology

Welcome to the world of Contactable, an Integrated Identity Platform (IIP) that revolutionizes digital identity, onboarding, and Know Your Customer (KYC) processes.

How Contactable enables onboarding?

Contactable enables the journey of digital identity, onboarding and KYC processes.

We understand the power of Integrated Identity Platforms (IIP) that cater to your specific needs, eliminating the hassle of ownership and integration complications.

Gone are the days of dealing with complex licenses and individual software installations.

Just as you use platforms like Uber or Spotify for on-demand transport and music without owning the underlying assets, Contactable offers a similar solution for digital identity, onboarding, and KYC processes.

Our platform automates and streamlines the verification of prospective clients, enabling businesses to confidently verify customer credentials within seconds.

Whether it’s a car purchase, a phone contract, or opening a new account, Contactable’s integrated processes allow businesses to efficiently verify customer information, sometimes requiring as little as a name and ID number.

Contactable takes care of the hard work of identifying, testing, and deploying integrations with various bureaus, agencies, and suppliers responsible for verifying person identities.

Digital Identity Proofing

By 2023, 75% of organizations will be using a single vendor with strong identity orchestration capabilities and connections to many other third parties for identity proofing and affirmation, which is an increase from fewer than 15% today

Gartner, September 2020

Latest from Contactable blog

A podcast with Shaun Strydom

One World Identity (OWI) recently rebranded to Liminal. The OWI podcast series is the leading voice on global trends in the Digital Identity space. They recently invited Contactable Founder and CEO, Shaun Strydom to record a podcast with Cameron D’Ambrosi.

Contactable Sponsors Tadhack South Africa 2021

Following our successful Gold sponsorship of the 2020 event, Contactable is happy to announce that we are again a Gold Sponsor of the 2021 Tadhack, run by MTN.

The Rise of Consumer-based Digital Identity In South Africa

Many companies in South Africa are digitizing their customer onboarding process…

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

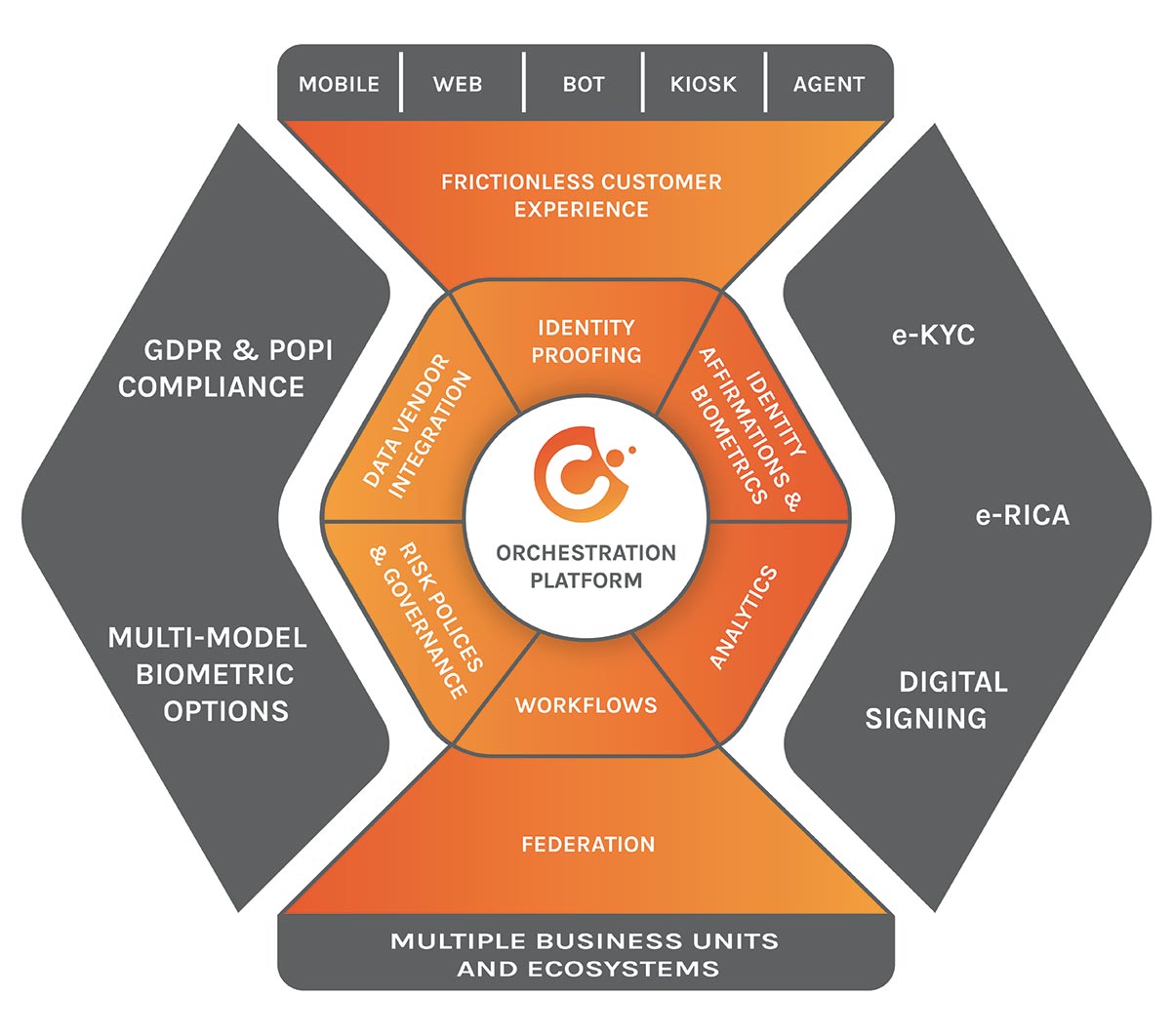

Digital Identity Orchestration to Enable Business

Join us in the world of Contactable and experience the seamless power of our Digital Orchestration Platform.

Customer Digital Onboarding

Use our API’s across all channels – Smartphone, Tablet, Web, BOT, Kiosk, USSD, agent and in-store – to automate your customer onboarding journey.

Customer Digital Identity

The customer’s digital identity corresponds to their real-world identity and facilitate digital authentication.

E-KYC

Digitise your KYC and compliance. Let our AI driven platform take care of the complexity.

Biometrics Multi Modal

Pins and passwords are a thing of the past and cybersecurity is on the rise.

Data integration

Access multiple data providers for different KYC requirements all from one platform.

Digital AI Orchestration

Bring all identity and KYC processes together in one place, configured for your unique requirements and risks.

Company Verification

Conduct juristic validation and director verification. Save time and remove the paperwork – digitise the process using our orchestration platform.

Self RICA SIM Registration

Focus on your core business whilst complying with international and local regulations.

Biometrics

Palm Vein Biometrics

Palm vein biometrics is widely believed to be the best No Touch biometric authentication method.

Facial Recognition

A facial recognition system uses biometrics to map facial features from a photograph or video.

Liveness

Liveness technology prevents intruders from breaching biometric authentication systems identifying presentation attacks or fraud.

Voice Biometrics

Voice biometrics uses a person’s natural voice pattern as a password for authenticating access to services.

Product Overview

- 01. Provide consent

- 02. Enter ID number or passport number

- 03. Take a selfie (the liveness test algorithm runs in the background)

- 04. Provide your address for data-source verification

- 05. Scan or Upload any required KYC documentation

- 06. All done!

Solving Industry Identity Challenges

PUBLIC SECTOR

Customer-centric service delivery made easy with the creation of a Digital Citizen relationship. Imagine if your local and national government interacted with you in the same way you interact with your bank or local mobile phone provider. After the establishing of a digital relationship and the addition of a biometric, the opportunities for future services are endless.

RETAIL

FINANCIAL SERVICES AND INSURANCE

ONLINE GAMING

TELECOMMUNICATIONS

Telecommunication companies are expanding their product range and adding new offerings to customers such as mobile money, insurance and other retail products. Central to this is the digital identity and the ability to federate the expanded offering across one identity relationship. Compliance with FICA and RICA is obligatory and offering customers a self-service is a ticket to the game.

MOTOR DEALERSHIPS

Motor dealerships are accountable institutions and required to comply with FICA. Customers can be pre-screened for creditworthiness and vehicle affordability. Frictionless onboarding and approval of financial and insurance offering followed by digital signing of contracts.

HEALTHCARE

Onboard patients in the same way financial institutions and retailers onboard customers. Attach biometrics to the identity and manage patient records securely, remotely and with easy integration to medical aid schemes.

BLOCKCHAIN SOLUTIONS

Digital identities are becoming central components of many blockchain solutions. Especially if individuals are required to be connected to devices or products in the blockchain ecosystem.

Proud to work with

Financial services – Insurance

Financial services – Motor vehicle finance & insurance

Retail, consumer & property

Financial services – Digital banking and merchants

F&I solution approved by four leading South African banks

Telco

What Makes Us Different?

REPORTS & PAPERS

Download our reports and white papers.

Contactable

GoVerify

FIND US

17 Via Salara Crescent, Irene Corporate Corner, Irene, Centurion, 0133, South Africa